![]() Home > World Business

Home > World Business

Mahathir Still Hates Currency Traders 20 Years After Asia Crisis

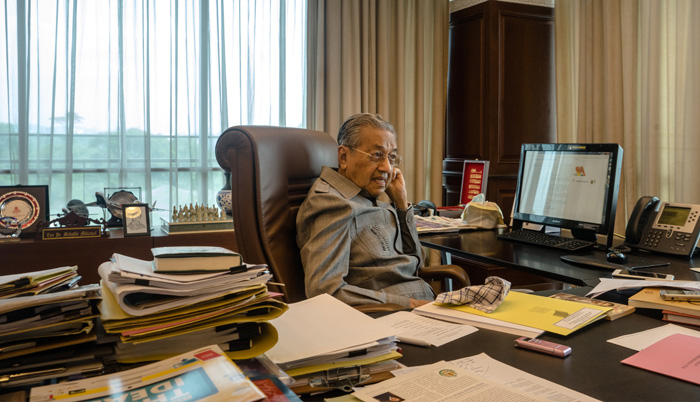

Mahathir Mohamad in his office.Photographer: Sanjit Das/Bloomberg

![]() July 6th, 2017 | 09:22 AM |

July 6th, 2017 | 09:22 AM | ![]() 2250 views

2250 views

MALAYSIA

As the Asian financial crisis raged on two decades ago, Malaysian Prime Minister Mahathir Mohamad committed economic heresy by rejecting an International Monetary Fund bailout and slapping capital controls on global investors.

Mahathir blasted currency traders as "unscrupulous profiteers" in an "immoral" line of work. Billionaire hedge fund manager George Soros, who bet big and won big against the British pound in 1992, returned fire, predicting that Mahathir’s policies would be a "recipe for disaster."

Not so it turned out. Malaysia’s economy contracted but quickly snapped back from the crisis. Mahathir’s controls were defended early on by Nobel Laureate Paul Krugman and with the passage of time even the IMF and World Bank have warmed up to the measures.

Mahathir, now 91, hasn’t lost any of his disdain for currency traders who drove Malaysia’s economy to the brink 20 years ago. “I believe that currency trading should not be a business at all,” he said in an interview in his office in Kuala Lumpur, housed in an Arabesque-styled building.

“There’s no point in treating a currency like a commodity, devaluing it artificially and causing a lot of poverty among poor countries,” Mahathir said.

Washington Consensus

Back in the late 1990s, the so-called Washington Consensus of unfettered capital flows and free-market capitalism was in fashion -- and hot money capital inflows were making life difficult for Asian economies.

In 1997, the Malaysian ringgit plummeted 35 percent, reserves dwindled and the stock market crashed and lost half its value. Instead of turning to the IMF, the government set up a National Economic Action Council, a high powered group chaired by the prime minister, to help stabilize the economy.

While other countries such as Thailand scrapped a dollar peg with its currency, Malaysia adopted one in late 1998. While regional central banks raised interest rates at the behest of the IMF to defend their currencies, Bank Negara Malaysia resisted, and eventually cut rates gradually from 11 percent in July 1998 to 5.5 percent by August 1999.

"They condemned us," former central bank Governor Zeti Akhtar Aziz said of investors, the IMF and rating companies when Malaysia ignored recommendations to raise rates. Zeti was appointed acting governor in September 1998 and was tasked on her first day to announce Malaysia would set limits on foreign-exchange transactions, trapping an estimated $18 billion of foreign capital for at least a year.

"We looked at it as a circuit breaker, that it could restore stability in the currency markets and overall, other financial markets as well," she said.

Mahathir’s heavy-handed approach worked. The fixed currency gave businesses the certainty to plan and invest. After initially contracting 7.4 percent in 1998, the economy rebounded to grow 6.1 percent in 1999. Unlike Thailand and Indonesia, Malaysia was spared from painful IMF austerity measures that spurred political chaos, pushed thousands of companies closer to bankruptcy and thrust millions into poverty.

“Mahathir read the mindset of the time correctly,” said Song Seng Wun, an economist at CIMB Private Banking in Singapore. “He understood the psychology, he didn’t give into the fear. He knew that if people lose trust in you, in the central bank, in the ringgit, then you’re gone.”

Turning Point

He also faced plenty of push-back within his own government. Mahathir said it took him a year to convince the special council of cabinet colleagues and advisers, who met almost daily at his office, to impose capital controls. One of the team members was Noordin Sopiee, an academic who provided a 32-point list on why it wouldn’t work, Mahathir recalls.

“We had to destroy every one of his 32 arguments,” said the former prime minister, dressed in a grey, trademark safari suit and peering through his rimless glasses. “I had to find ways of pointing out why they were wrong."

What convinced them, said Mahathir, was Nobel prize winner Krugman’s arguments in favor of exchange controls in Asia. “He is a great economist and all that, so they were convinced by him rather than by me,” Mahathir said.

Domestic political considerations also played a role in Mahathir’s thinking. One of the main reasons for rejecting the IMF and World Bank aid was the fear that the Washington-based lenders would force him to abandon Malaysia’s affirmative action policies that has helped kept his ruling party in power for decades.

Debt Pressure

“When we borrow money from them, the condition they often impose is that they have a hand in the management of the economy of the country, including the finances,” Mahathir said. "Affirmative action is not something that the World Bank believes in or promotes."

It’s a legacy of those policies that may be hindering Malaysia’s progress today. Business leaders argue that the affirmative-action programs impede competitiveness, shackling an economy that’s begun to lag those of its peers. The government says they are still needed to improve the economic plight of Malays.

Mahathir lays the blame for the economy’s current woes at the door of his once-ally and now foe, Prime Minister Najib Razak. The current administration is overburdening the economy by borrowing beyond its means and corruption is rife, said Mahathir.

“The current government has borrowed too much money,” he said. “When you cannot repay your debts, countries -- like Greece -- can go bankrupt.”

Najib’s press secretary Tengku Sariffuddin said more than 2.2 million jobs have been created in Malaysia in the last six years and the country has had healthy growth amid uncertainty in the global economy. There remains global confidence in the Malaysian economy even as opposition politicians including Mahathir are trying to "sabotage" it for political gains, he said.

Despite his age, Mahathir shows no signs of letting up. He follows a rigorous routine, arriving at his office at 8.30 a.m., greeting an array of visitors, and blogging regularly, often about politics.

Mahathir said he isn’t concerned about his legacy at this point in his life. “I don’t care much whether people remember me or not,” he said. “If people remember, well and good. If they don’t remember, it’s alright, I’m dead anyway.

Source:

courtesy of BLOOMBERG

by Nasreen Seria and Y-Sing Liau

If you have any stories or news that you would like to share with the global online community, please feel free to share it with us by contacting us directly at [email protected]