![]() Home > World Business

Home > World Business

Natwest Chair Sir Howard Davies Says He Won't Quit Over Farage Row

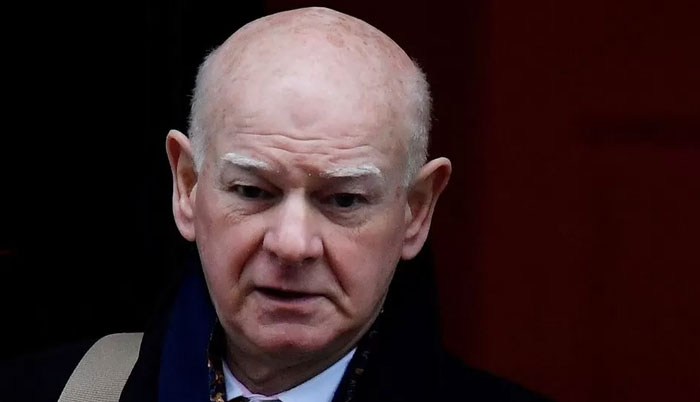

REUTERS | Sir Howard said Dame Alison's position had become "untenable"

![]() July 29th, 2023 | 11:35 AM |

July 29th, 2023 | 11:35 AM | ![]() 296 views

296 views

WORLD BUSINESS

NatWest's chair has said he will not quit after initially backing former boss Dame Alison Rose in the row over the closure of Nigel Farage's account.

Sir Howard Davies said on Friday he would continue at the bank to ensure "stability" after the resignations of Dame Alison and the boss of Coutts.

NatWest is 39% owned by the taxpayer and Sir Howard said: "We do have the support of our main shareholder."

However, on Thursday, the prime minister refused to back Sir Howard.

When asked if he would support the chair staying on until the middle of next year when Sir Howard is due to step down, Rishi Sunak said: "This isn't about any one individual, it's about values - do you believe in free speech and not to be discriminated against because of your legally held views?"

Sir Howard's pledge to stay on came as the bank announced a sharper-than-expected rise in first-half profits - the last set of results under the leadership of Dame Alison. Pre-tax profits in the six months to 30 June soared to £3.6bn, from £2.6bn a year earlier.

'Political reaction'

Dame Alison left the bank earlier this week "by mutual consent" with the board after admitting she had made a mistake in speaking about Mr Farage's relationship with Coutts, a subsidiary of NatWest which is focused on wealthy clients.

Earlier this month, former UKIP leader Mr Farage said that his account at Coutts had been closed and that he had not been given a reason.

The BBC reported that it was closed because he no longer met the wealth threshold for Coutts, citing a source familiar with the matter.

However, Mr Farage later obtained a report from the bank that indicated his political views were also considered.

Hours before Dame Alison resigned over the closure of Mr Farage's Coutts account, Sir Howard said the board retained "full confidence" in her.

However, the BBC was told that Downing Street and Chancellor Jeremy Hunt had "significant concerns" over Dame Alison's conduct.

On Friday, Sir Howard said: "The reaction, the political reaction... was such that Alison and I then concluded, and the board supported the view, that her position was then untenable."

He added: "She would be running the bank in the face of very difficult headwinds and therefore we made a different decision."

The day after Dame Alison's resignation, Peter Flavel, the chief executive of Coutts, a subsidiary of NatWest where Mr Farage held his account, also quit.

Mr Farage has called on Sir Howard to also step down.

While announcing NatWest's half-year results, Sir Howard said the bank had appointed City law firm Travers Smith to conduct an independent investigation into the closure of Mr Farage's account and how the information surrounding the issue had been handled.

The independent investigation will:

Review the decision to shut Mr Farage's accounts, including how it was identified for closure

Examine the circumstances surrounding the BBC story and if any leak of confidential customer information or breach of the General Data Protection Regulation occurred.

Review of Coutts' account closures over the past two years

Travers Smith is expected to report back on the questions surrounding Mr Farage and any leak of confidential information with four to six weeks.

On the closure of Coutts customer accounts, the law firm will report back by the end of October this year.

Victoria Scholar, head of investment at Interactive Investor, told the BBC's Today programme: "It is a real shame that Alison Rose had to go.

"We know that she was a role model to many and a champion of diversity and inclusion but clearly her discussions [about] Nigel Farage have breached client confidentiality, which is absolutely sacrosanct in the industry and means her role is no longer tenable."

NatWest declined to comment on what, if any, severance package Dame Alison would receive. Sir Howard said that any decisions on her pay would be made after the independent investigation had concluded and set out in the bank's annual report.

Last year, Dame Alison, who worked at NatWest for more than 30 years, was paid £5.25m.

In his first outing as Dame Alison's interim replacement, NatWest chief executive Paul Thwaite said: "It is an understatement to say that these are not ideal circumstances for anyone to take over.

"It is clear to me that we got some things wrong. It will take time to address some of those challenges. But I've already taken action and I'm determined we learn and start to move forward quickly."

Reforms

Prior to the situation between Mr Farage and Coutts, the government had been examining the termination of customer bank accounts.

Under new reforms, banks will have to give customers a 90-day notice period. This will give customers time to challenge a decision through the Financial Ombudsman Service or find a replacement bank.

Banks can enforce a shorter notice period if they have to comply with financial crime law.

Lenders will also be required to spell out why they are closing a bank account.

There will be limited exceptions, such as ensuring that bank communications are not interfering with investigations into criminal activity.

Meanwhile, the Financial Conduct Authority is reviewing how rules around "politically exposed person" or PEPs are enforced by banks.

PEPs are people who hold a prominent position or influence who may be more susceptible to being involved in bribery or corruption.

Banks are required to do extra due diligence on PEPs.

However, the government has said some banks might be "failing to strike the right balance" in their approach to providing services to PEPs.

Source:

courtesy of BBC NEWS

by Dearbail Jordan | BBC News

If you have any stories or news that you would like to share with the global online community, please feel free to share it with us by contacting us directly at [email protected]